BBG Watch Commentary

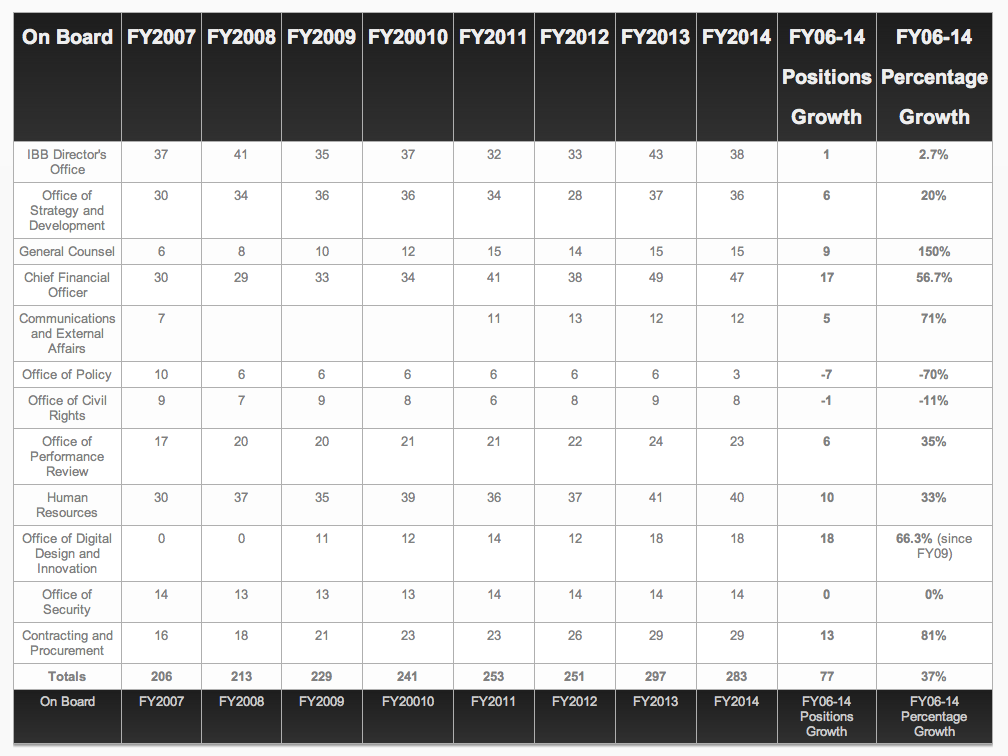

The Broadcasting Board of Governors (BBG) today released its detailed Fiscal Year 2015 budget request which calls for major reductions in news reporting, programs and programming positions. The International Broadcasting Bureau (IBB), which will also see some reductions, continues to control the largest portion of the BBG budget (34%). The number of IBB positions has grown 37% during the last seven years while programs and programming positions were being cut and will continue to be cut in Fiscal Year 2015 under the proposed budget.

The Broadcasting Board of Governors (BBG) today released its detailed Fiscal Year 2015 budget request which calls for major reductions in news reporting, programs and programming positions. The International Broadcasting Bureau (IBB), which will also see some reductions, continues to control the largest portion of the BBG budget (34%). The number of IBB positions has grown 37% during the last seven years while programs and programming positions were being cut and will continue to be cut in Fiscal Year 2015 under the proposed budget.

Major cuts to programs are barely mentioned in possibly one of the most outrageously insulting to the staff, misleading and uninformative BBG (actually IBB) press releases:

BBG To Become More Nimble And Streamlined Under The FY15 Budget Request, BBG PRESS RELEASE

The arrogantly-worded IBB press release refers to these devastating major programming cuts as “eliminating needless language service overlap.”

The BBG budget request document itself is also full of meaningless bureaucratic jargon and attempts to draw attention away from a major reduction in news reporting in multiple languages and to minimize the fact that the constantly growing IBB bureaucracy still continues to dominate the agency and continues to cut programs.

###

THIS IS IBB DOCUMENT

BBG Fiscal Year 2015 Congressional Budget Request

Language Service and Newsgathering Reductions

VOA

Reduce Central News Positions [-$2.19M]

This proposal involves streamlining and restructuring English language newsgathering at VOA. VOA Central News will accelerate its transition to multimedia production of original news content while reducing its output of blended news wires for language service translation. Central News will also act as a clearinghouse for original content produced by VOA language service journalists. The strengths of VOA, RFE/RL Central News, and the other BBG broadcast networks will be leveraged to enhance global newsgathering for all U.S. international media networks. This inter- network coordination is already underway, with significant sharing of original content, coverage, and feeds of major news events between the USIM networks.

Due to retirements and other separations in the past several years, and the Agency’s efforts to avoid filling vacancies wherever possible under sequestration, cuts to Central News will be largely or entirely limited to vacant positions, not to staff currently on board. Nineteen positions will be eliminated in VOA Central News under this proposal.

Close Jerusalem News Bureau [-$0.29M]

VOA will close its bureau in Jerusalem, but will continue to have a free-lance reporter there. One position will be eliminated under this reduction.

Reduce Domestic Bureaus [-$.25M]

VOA will obtain coverage of events in Miami by using VOA Latin America Division staffers working out of OCB headquarters, by contracting as necessary with local stringers, and through additional cooperation with OCB. VOA does not have an office in Houston; this reduction will eliminate VOA’s Houston correspondent. One vacant position in Miami and one position in Houston will be eliminated under this reduction.

Realign English Radio [-$0.55M]

Long-form English radio products for regions other than Africa have little measured audience and very little placement with affiliates. These legacy programs will be ended in favor of new Learning English content, as well as short-form reports and other content for placement with affiliates plus on VOA’s growing network of FM transmitters in Africa. This realignment will involve an internal transfer of positions and GOE within the English Division as well as a reduction. The internal realignment will move 13 positions and $99,000 in GOE to Learning English with a net $0 impact to the English Division. Additionally, five vacant positions in English will be eliminated.

Reduce VOA Persian [-$2.3M]

VOA Persian will streamline its program mix to focus efforts on a core set of programs, scale back talk show programming which requires elaborate booking, and add more news about and from America. VOA Persian will continue to produce 18.25 weekly hours of original TV, in addition to content for its multimedia web and mobile sites and apps. Five positions will be eliminated in PNN under this proposal.

Reduce Latin America Division [-$0.68M]

The Latin America Division will reduce its long form television programs and focus on its effective US Bureau strategy of interactives with stations across the region, and further targeted limited radio programming. This change reduces two positions and some contract staff.

Eliminate VOA Albanian, Bosnian, Macedonian, and Serbian Services [-$2.25M]

Media environments in the Balkans are increasingly diverse, sophisticated, and crowded. Abundant indigenous channels provide continuous local and national coverage. Other Western broadcasters, such as the BBC, have already withdrawn. Bosnia and Herzegovina, Kosovo, Serbia, and Albania all improved their standing in the latest Reporters Without Borders World Press Freedom Index, and the Balkan countries are undertaking the reforms necessary to gain membership in the European Union and NATO.

While VOA has been extremely successful in the Balkans over the course of many years, in a difficult budget environment, the BBG can no longer sustain broadcasting to this region while also adequately funding broadcasting to regions of growing importance to U.S. national security, such as Asia and Africa.

This reduction will eliminate the following VOA Balkan services: Serbian (eight positions, $0.5 million), Albanian (nine positions, $1.14 million), Bosnian (five positions, $0.41 million), and Macedonian (two positions, $0.2 million).

Reduce Indonesian Radio [-$0.30M]

VOA reaches very large audiences in Indonesia, but almost all of that comes from TV; radio contributes only a percentage point or two to overall reach. This reduction continues to scale back radio broadcasting by 7 hours, ending a daily 60-minute show that includes news, editorials, correspondent reports, features about America, personal development, and infotainment. Almost 50 weekly hours of radio will continue after this reduction, as will the high-reach television programs. Three positions in Washington and one FSN in Indonesia will be eliminated under this reduction.

Reduce Georgian Service [-$0.14M]

The BBG has two Georgian services, leading to a total expenditure that is out of proportion to the priority level of the country for broadcasting. VOA will collaborate with RFE/RL Georgian to maintain an adequate level of service to Georgian audiences at reduced expenditure. One position will be eliminated under this reduction.

Reduce Uzbek Service [-$0.12M]

The BBG has two Uzbek services, both of which struggle to reach audiences due to extreme restrictions on access to local media in this closed society. Uzbekistan is an important target for BBG broadcasts, and the BBG can improve efficiency through VOA-RFE/RL coordination. This reduction through efficiency will lead to a similar level of service for audiences at a lower total cost. One position will be eliminated under this reduction.

Reduce Azerbaijani Service [-$0.14M]

The BBG has two Azerbaijani services. VOA Azerbaijani will work with RFE/RL Azerbaijani on joint programs, with VOA acting as the “U.S. Bureau” in an integrated broadcast, while RFE/RL focuses primarily on local news. This cooperation will allow VOA to reduce costs by concentrating on its reporting only on U.S. issues. One position will be eliminated under this reduction.

Office of Cuba Broadcasting [-$3.91M]

In FY 2015, the BBG anticipates that OCB may receive up to a $5 million transfer from the Economic Support Fund to support programs and activities allowed in accordance with the Cuban Liberty and Democratic Solidarity (Libertad) Act of 1996. This will leverage the well-established relationships on the island maintained by OCB to conduct activities in accordance with the Libertad Act. At the FY 2015 Budget Request funding level, OCB may be required to reduce the number of positions.

RFE/RL

Reduce Armenian Service [-$0.38M]

The BBG has two Armenian services, leading to a total expenditure that is out of proportion to the priority level of the country for broadcasting. RFE/RL will scale back its extensive radio programming slightly, with little anticipated reduction to overall audience in Armenia. One position will be eliminated under this reduction.

Reduce Belarusian Radio [-$0.25M]

In conjunction with the medium wave transmission reductions proposed in this Budget Request, RFE/RL’s Belarus Service will reduce its expenses in order to focus on platforms that have more potential for growth. These include satellite-based audio, a satellite television program broadcast via Belsat, a Poland-based channel targeting the country, and multimedia web and mobile sites and apps.

Additional Reductions

International Broadcasting Bureau [-$11.22M]

The 2015 the BBG Budget submission contains a substantial reduction to the operating budget of its International Broadcasting Bureau (IBB). The total for IBB includes a Digital Media Investment of $10.2 million. This reduces the non-investment funds available to the IBB from $66 million in FY 2014 to $54.5 million in FY 2015. This is an almost 17% reduction in operational funds.

The IBB budget is composed primarily by salaries and as such will require substantial analysis in order to determine the most cost effective manner to achieve the required savings while preserving the ability of the IBB to continue its mission critical support of the entire Federal entity including the Offices of the Voice of America (VOA), Technology, Services and Innovation (TSI) and the Office of Cuba Broadcasting (OCB).

At present, the BBG has engaged the assistance of the Office of Personnel Management via its Human Resources Solutions division and expects to have completed its analysis within the third quarter of FY 2014.

Upon completion of this analysis, the BBG will submit additional detail the IBB component that is compliant with its budgetary targets.

END OF IBB DOCUMENT

Broadcasting Board of Governors

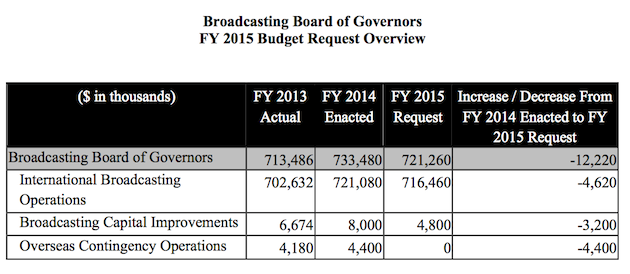

FY 2015 Congressional Request – $721.26 million

Funding by Major Elements ($ in millions)

(The IBB-produced chart was modified by BBG Watch to show that IBB is the largest BBG element and controls 34% of the BBG budget.)