VOA Charter Commentary

Steve Peacock reported in an article on the WND website that “the Obama administration is looking to negotiate with the Socialist Republic of Vietnam, the government that emerged after a war costing more than 58,000 American lives, to carry a ‘Welcome to America’ radio program over its state radio station.

“If the U.S. Broadcasting Board of Governors, or BBG, has its way, its Voice of America program will work in tandem with the Voice of Vietnam, or VOV, to broadcast the 15-minute prime-time radio program Monday through Friday across the communist nation.”

READ MORE: OBAMA TALKS WITH COMMUNISTS TO AIR RADIO SHOW Former enemy could broadcast ‘Welcome to America’, Steve Peacock, WND, August 31, 2014.

More specifically, this is an initiative of the Voice of America (VOA) senior management working with the BBG’s International Broadcasting Bureau (IBB).

We assume that the VOA and IBB management is fully aware that this program placement, while it may be desirable in their view for increasing audience size in Vietnam, will be in clear violation of the Voice of America Charter and therefore U.S. law. They know very well that the communist government of Vietnam will not allow VOA through this program placement to “serve as a consistently reliable and authoritative source of news,” nor will this program placement allow VOA news to “be accurate, objective, and comprehensive,” as required by the VOA Charter.

The proposed contract announces that the Voice of America program produced for placement will not include any political news, which represents VOA’s agreement to censor itself and a violation of the VOA Charter.

“The 15-minute Voice of America radio program brings the Vietnamese audience a compilation of reports on current cultural, scientific, educational, social, arts and lifestyle activities in the United States.”

The Broadcasting Board of Governors / International Broadcasting Bureau contract further specifically grants the Vietnamese side the right to censor the Voice of America program by refusing to air it.

“The distributor will coordinate with VOV Giao Thong, Radio 91 FM to broadcast the program in its entirety, without pre-emption, alteration, abridgement or excerption. However, VOV Giao Thong, Radio 91 FM, shall have the right to determine whether a specific program is in accordance with the laws of Vietnam and will have the option not to air such a specific program if it so chooses.”

Voice of America executives know very well that any kind of criticism of the government of Vietnam and its policies by Vietnamese Americans, other Americans, or anyone else is not “in accordance with the laws of Vietnam,” if not in strict legal sense, then certainly in practice. VOA and IBB executives know very well that this may be a standard contract clause in democratic countries to cover any legal peculiarities, but in Vietnam it means excluding voices critical of the government.

The U.S. State Department 2013 Human Rights Report has this to say what is legal and not legal for the media in Vietnam to do:

Although the constitution and law provide for freedom of speech, including for members of the press, the government continued to use broad national security and antidefamation provisions to restrict these freedoms. The law defines the crimes of “sabotaging the infrastructure of socialism,” “sowing divisions between religious and nonreligious people,” and “propagandizing against the state” as serious offenses against national security. It also expressly forbids “taking advantage of democratic freedoms and rights to violate the interests of the state and social organizations.”

This is how the U.S. State Department summarizes the human rights situation under the government of Vietnam with which Voice of America, International Broadcasting Bureau and Broadcasting Board of Governors executives want to strike a deal that is consistent with communist law and would ban critics of the Vietnamese government from the proposed VOA program or any references to human rights abuses in Vietnam.

The Socialist Republic of Vietnam is an authoritarian state ruled by a single party, the Communist Party of Vietnam (CPV), led by General Secretary Nguyen Phu Trong, Prime Minister Nguyen Tan Dung, and President Truong Tan Sang. The most recent National Assembly elections, held in 2011, were neither free nor fair. Authorities maintained effective control over the security forces. Security forces committed human rights abuses. The most significant human rights problems in the country continued to be severe government restrictions on citizens’ political rights, particularly their right to change their government; increased measures to limit citizens’ civil liberties; and corruption in the judicial system and police.

VOA and IBB executives in effect agree in writing to silence a large segment of the Vietnamese American community and other Americans critical of the communist government of Vietnam to an audience in Vietnam that may be larger than the Internet audience. It could very well mean that the largest segment of the Voice of America audience in Vietnam would be getting a VOA program that violates the VOA Charter by excluding and censoring American voices. This would be a clear violation of U.S. law as written in the VOA Charter.

The proposed contract refers to Voice of Vietnam (VOV) “program controllers and editors.”

“The Broadcasting Board of Governors (BBG), is seeking a program distributor with the ability to successfully negotiate a contract with the national broadcaster of the Socialist Republic of Vietnam, the Voice of Vietnam (VOV)-specifically the VOV network known as VOV Giao Thong, Radio 91 FM-to lease 15 minutes in prime time, Monday through Fridays. The time leased would be used to broadcast the BBG’s audio program, Welcome to America, with full branding and credit to the Voice of America.”

The VOA and IBB management must be aware that in addition to excluding “accurate, objective, and comprehensive” news, this deal with the communist government of Vietnam will be in violation of the second provision of the VOA Charter which requires VOA to “represent America, not any single segment of American society, and … therefore present a balanced and comprehensive projection of significant American thought and institutions.”

Senior Voice of America and International Broadcasting Bureau executives have to be aware that strong criticism of the communist government in Vietnam by Vietnamese Americans or other Americans will not be permitted in any VOA program allowed by the Vietnamese authorities to air on Radio Vietnam.

Senior VOA and IBB executives also must know that the Vietnamese government will also not permit any strong criticism of their policies and actions by any representatives the U.S. government, including criticism by members of the U.S. Congress, to air in any program allowed by the Vietnamese government on the national broadcaster. U.S. taxpayer-funded Voice of America wants to place the program on the Voice of Vietnam (VOV), specifically the Voice of Vietnam network known as VOV Giao Thong. No uncensored Voice of America program with real news will be allowed on any network controlled by the communist government of Vietnam.

With this contract, senior VOA and IBB executives in effect announce that they do not intend to apply the VOA Charter (U.S. Public Law 94-350) to any program that might be allowed to air on the Voice of Vietnam network. These executives are in effect announcing to U.S. taxpayers who will pay for this program and for its placement that they are agreeing to censorship to please the communist government of Vietnam.

Presumably, audiences in Vietnam can still get uncensored news from the VOA website or from Radio Free Asia (RFA) website and radio broadcasts. But this BBG/IBB/VOA deal with the communist government of Vietnam sets a dangerous precedent for censorship and double standards for Voice of America programming. While the arrangement may be with the Voice of Vietnam, it is in fact a deal with the communist government of Vietnam.

VOA, IBB and BBG executives are in effect overlooking and rewarding Internet censorship by the communist government of Vietnam by saying that they will produce censored a VOA program if the communist authorities allow it to be broadcast in Vietnam while Internet censorship continues. The U.S. State Department 2013 Human Rights Report says:

The government continued to exercise various forms of control over internet access, including disincentives to its use by citizens. It allowed access to the internet, but only through a limited number of internet service providers (ISPs), all of which were state-controlled companies or companies with substantial state control. According to government statistics, nearly 36 percent of citizens had access to the internet. The government used firewalls to block websites it deemed politically or culturally inappropriate, including sites operated by overseas Vietnamese political groups. In addition, the government continued at times throughout the year to block Radio Free Asia and the BBC Vietnamese and English websites.

Members of the bipartisan Broadcasting Board of Governors, members of Congress and representatives of the Vietnamese American community should demand an immediate explanation from Voice of America and International Broadcasting Bureau executives, as well as from the Broadcasting Board of Governors, how this deal with the communist government of Vietnam, known for its press censorship and domestic political repression, does not violate the VOA Charter and U.S. law.

The VOA Charter, which is U.S. law, should not be allowed to be ignored, abused and violated so that VOA executives could say that they have a large audience in Vietnam.

It will be a large audience for a self-censored VOA program, which violates the VOA Charter and U.S. law.

All VOA, IBB and BBG senior executives have to do is to look at the Voice of Vietnam English website and read a few reports, such as “President Ho Chi Minh’s testament- Light of wisdom and faith,” which talks about Ho Chi Minh’s “invaluable ideological legacy including his testament, which has great historical significance for national construction and defense,” and “his belief in the Vietnamese people’s ultimate victory in the war against America.” This seems hardly a good fit for VOA programs, especially if they are stripped of news and censored for any criticism of the Vietnamese communist government.

All VOA, IBB and BBG senior executives have to do is to look at the Voice of Vietnam English website and read a few reports, such as “President Ho Chi Minh’s testament- Light of wisdom and faith,” which talks about Ho Chi Minh’s “invaluable ideological legacy including his testament, which has great historical significance for national construction and defense,” and “his belief in the Vietnamese people’s ultimate victory in the war against America.” This seems hardly a good fit for VOA programs, especially if they are stripped of news and censored for any criticism of the Vietnamese communist government.

VOA executives are already engaged in a similar deal in Russia, where with the tacit approval of the Kremlin propaganda experts, VOA participate in a program with a Russian television channel. The Russian TV network uses it to promote the Kremlin propaganda line and criticize the United States.

In the Russian case, VOA ceded the control of the program to the Russian side and had to agree, at least silently, to be circumspect in discussing certain topics. In addition, the VOA team participating in the program with the Russian TV channel turned out to be extremely weak, allowing the Russian side to use the program to embarrass VOA and the United States.

The Russian side is using the program with VOA to increase support for Putin domestically and to claim at the same time that there is no censorship in Russia, even though direct VOA and Radio Liberty rebroadcasts in Russia, which the Russian government could not control, were banned. It is a Russian propaganda program with Voice of America’s participation.

Observers pointed out that journalists who truly expose official propaganda and corruption in Russia either get killed, imprisoned or fined, and their media outlets are closed down by the authorities.

By agreeing to these program placement arrangements with repressive regimes and agreeing to practice self-censorship, Voice of America and International Broadcasting Bureau executives are in effect undermining media freedom. In Russia, they are in effect helping the Kremlin to spread its propaganda because of VOA’s extremely poor performance in the television program with the Russian network.

The Broadcasting Board of Governors, which controls VOA, says that its mission is “to inform, engage and connect people around the world in support of freedom and democracy,” but BBG members allow these VOA deals with repressive governments to proceed even though they violate the VOA Charter and U.S. law.

This program placement proposal between the Voice of America and the Voice of Vietnam under the control of Vietnam’s communist government is very reminiscent of similar arrangements between the state radio broadcaster of the Soviet Union and state radios in communist-ruled countries dominated by Moscow. These programs were devoid of any real news but full of feel-good propaganda.

The VOA Charter and U.S. law are being ignored, abused and violated after a model provided by communist Radio Moscow.

SEE: Voice of America helped Russia score propaganda points with poor VOA performance in a TV project, BBG Watch, September 2, 2014.SEE: Information war – Russia 2 : Voice of America 0, experts agree, BBG Watch, September 7, 2014.

###

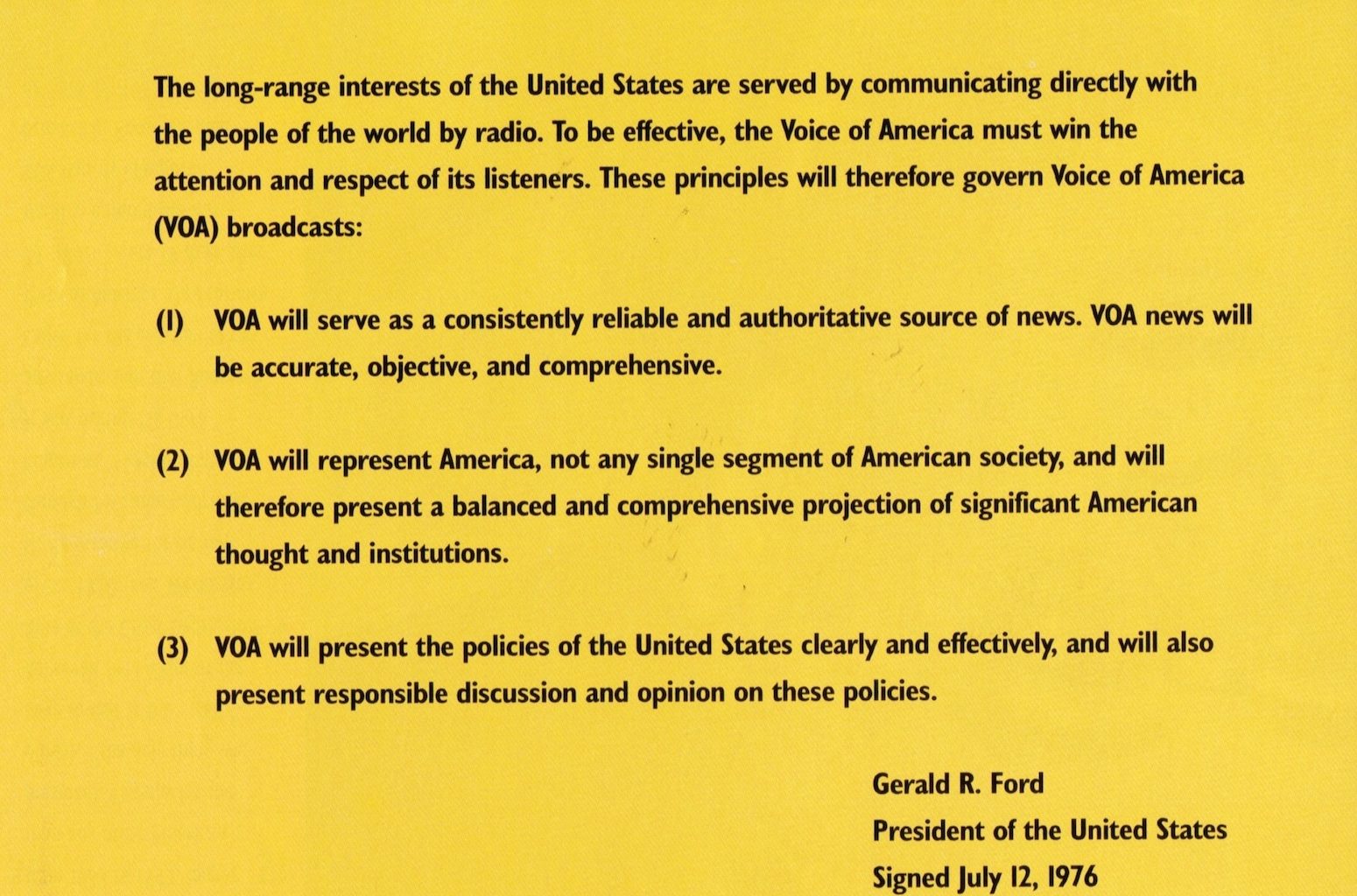

VOA CHARTER

To protect the integrity of VOA programming and define the organization’s mission, the VOA Charter was drafted in 1960 and later signed into law on July 12, 1976, by President Gerald Ford. It reads:

The long-range interests of the United States are served by communicating directly with the peoples of the world by radio. To be effective, the Voice of America must win the attention and respect of listeners. These principles will therefore govern Voice of America (VOA) broadcasts:

1. VOA will serve as a consistently reliable and authoritative source of news. VOA news will be accurate, objective, and comprehensive.

2. VOA will represent America, not any single segment of American society, and will therefore present a balanced and comprehensive projection of significant American thought and institutions.

3. VOA will present the policies of the United States clearly and effectively, and will also present responsible discussions and opinion on these policies. (Public Law 94-350)

###

Radio Program – Welcome to America

:Added: Aug 20, 2014 3:04 pmGeneral Information

Document Type: Combined Synopsis/Solicitation

Solicitation Number: BBG50-R-14-00050AM – Distribution of Welcome to America

Posted Date: August 20, 2014

Original Response Date: September 3, 2014

Contracting Officer Address:

Broadcasting Board of Governors (BBG)

Attn: Diane Sturgis, Contracting Officer

Room 4032A

330 C Street, S.W.

Washington, DC 20237

THIS IS A COMBINED SYNOPSIS/SOLICITATION for commercial items prepared in accordance with the format in Subpart 12.6, as supplemented with additional information included in this notice. This announcement constitutes the only solicitation; proposals are being requested and a separate WRITTEN SOLICITATION WILL NOT BE ISSUED. The solicitation number BBG50-R-14-00050AM is issued as a request for proposal (RFP) for the acquisition of content distribution services, in support of the Broadcasting Board of Governors 330 Independence Avenue, Washington, D.C., 20237. The period of performance shall consist of a Base period of twelve (12) months, with one, twelve (12) month option period.SPECIFICATIONS/STATEMENT OF WORK:

The Broadcasting Board of Governors (BBG), is seeking a program distributor with the ability to successfully negotiate a contract with the national broadcaster of the Socialist Republic of Vietnam, the Voice of Vietnam (VOV)-specifically the VOV network known as VOV Giao Thong, Radio 91 FM-to lease 15 minutes in prime time, Monday through Fridays. The time leased would be used to broadcast the BBG’s audio program, Welcome to America, with full branding and credit to the Voice of America.

The distributor would undertake to carry out the relaying operation of the program to VOV Giao Thong Radio 91 FM, provided for each and every day of the Contract Period and ensure that the programs are transmitted in accordance with the term of the contract. The distributor would also be responsible for coordination with VOV program controllers and editors.

The BBG is seeking a distributor that can demonstrate past success in concluding agreements that have placed content from international broadcasters on VOV. The distributor would also have the ability to show it placed content for numerous global clients across TV, Radio and IP platforms and demonstrate a proven track record in content management, storage, archive, and distribution solutions.Welcome to America

The 15-minute Voice of America radio program brings the Vietnamese audience a compilation of reports on current cultural, scientific, educational, social, arts and lifestyle activities in the United States.

A demo of the program is available on the following site:

Link: https://vimeo.com/85859780The distributor will coordinate with VOV Giao Thong, Radio 91 FM to broadcast the program in its entirety, without pre-emption, alteration, abridgement or excerption.

However, VOV Giao Thong, Radio 91 FM, shall have the right to determine whether a specific program is in accordance with the laws of Vietnam and will have the option not to air such a specific program if it so chooses.

Program shall be transmitted by BBG via satellite or Internet/FTP to the distributor with technical details of the transmission and feed transmission times to be mutually agreed upon.

THE FOLLOWING FACTORS SHALL BE ADDRESSED IN THE TECHNICAL PROPOSALS AND SHALL BE USED TO EVALUATE PROPOSALS:

1) Technical Approach: The contractor must provide a narrative detailing the approach that they will take to meet the requirement. The contractor must illustrate its understanding of the requirement and its ability to provide the required services stated herein.

2) Experience: The Offeror shall provide recent examples (within the past three (3) years) demonstrating its experience in providing the services required under this Solicitation to Governmental and/or commercial customers. Examples provided should be of the same and/or similar services specified herein.

3) Past Performance: The Offeror shall have demonstrated past performance in radio/tv/broadcast content placements. Technical proposals shall contain detailed information on past performance and relevant contracts for same and/or similar services with a minimum of three (3) references including contract numbers, points of contact with telephone numbers and email addresses (i.e., the point of contact who can verify performance). The BBG shall evaluate the Offeror’s Past Performance pursuant to FAR 15.305(a)(2). Each Offeror’s Past Performance shall be determined to be favorable or unfavorable. Pursuant to FAR 15.305(a) (2) (iv), in the case of an Offeror without a record of relevant past performance or for whom information on past performance is not available, the Offeror will not be evaluated favorably or unfavorably on past performance.

THE FOLLOWING FACTORS SHALL BE ADDRESSED IN THE PRICE PROPOSALS AND SHALL BE USED TO EVALUATE PROPOSALS:

Price Proposal: Offerors shall submit a separate Price Proposal showing an all-inclusive price of program placement on VOV’s Giao Thong, Radio 91 FM for 258 airings of Welcome to America. The prices shall be provided in English and United States dollars. The Government will evaluate the price proposal by:

1. comparing the proposed prices received in response to the solicitation against the IGE and historical prices paid by the Government for the same or similar services;

2. assessing the responsiveness of the Offeror in providing the requested prices

Offerors are cautioned that failure to address each of the above technical factors (and subfactors) and price factors may deem their proposal unacceptable. Proposals which are non-conforming will be rejected at the sole discretion of the Contracting Officer.

Technical Qualifications and Past Performance, when combined, are approximately more important than price.BASIS FOR AWARD

The Federal Acquisition Regulation (FAR) provision FAR 52.212-2 Evaluation-Commercial Items, applies to this solicitation. The Government will award a Commercial Item, Firm-Fixed-Price, contract resulting from this RFP to the responsible Offeror (s) whose offer conforming to the RFP will result in a best value to the Government, based on technical capability, experience, past performance and price. The Government intends to make a best value selection. All evaluation factors other than price, when combined, are significantly more important than price.

The Government plans to award without discussions, but may conduct discussions if it deems it is in the Government’s best interest. In the event that the Government conducts discussions from Offerors who are determined to be in the Competitive Range in accordance with FAR 15.307, it is the intention of the Government to conduct discussion/negotiations either via email or via telephone.

(i) Technical approach based on delivery of International Broadcast Programs content to VOV Giao Thong, Radio 91 FM.

(ii) Price

(iii) Past Performance -the offeror’s past performance in working with international broadcasters and in placing international broadcast content to VOV Giao Thong, Radio 91 FM.BASE PERIOD: Effective date for this procurement shall be September 22, 2014 with the first broadcast scheduled for on or about September 29, 2014. Duration of this procurement shall be twelve (12) months, ending September 21, 2015, with one (1) additional, one year- period.

OPTION PERIOD(S): Prior to the end of the Base Period, this agreement may be extended, confirmed in writing, for one (1) additional, one-year period under the same terms and conditions as the Base Period. The total duration of the Agreement including extensions shall not exceed two (2) years or through September 21, 2016.

Option Year 1: September 22, 2015 – September 21, 2016

The Parties agree that BBG may partially exercise any option and may do so multiple times up to the point that the option has been fully exercised. The distributor, however, will not be entitled to any compensation beyond the total amount of the option exercised. If BBG partially executes an option, Distributor’s sole obligation is to provide the ordered portion and BBG’s sole obligation is pay for the ordered portion. If BBG partially executes an option, BBG’s partial execution will not imply BBG will execute the remainder of the option. If BBG partially executes the option and does not execute the remainder of the option, BBG will have no further obligation under the contract to Distributor, that is, BBG’s entire obligation to Distributor will be to pay for the ordered portion (and any previously ordered portions).

PAYMENT AND BILLING

In consideration of transmissions of BBG provided programming in accordance with the terms of this Agreement, BBG will pay Distributor for the successful distribution it provides BBG in United States Dollars (less any deductions for time lost) after Distributor has transmitted the programming and upon receipt by BBG of a proper invoice from Distributor. Payments will be made by Electronic Fund Transfers (EFT) to a designated bank account for Distributor.

Distributor will commence invoicing after the first thirty (30) days of Distributor’s broadcasting of BBG’s programs from Distributor’s transmission facility(ies). Distributor will expect to receive payment within thirty (30) calendar days of BBG’s receipt of a proper invoice. Distributor shall provide invoices after every month for the services provided during the preceding month. Each proper invoice shall accurately reflect the actual cumulative duration of broadcast time during the month being billed. Such invoice shall show deductions for time lost unless such loss was caused by the BBG’s failure to deliver the programming to Distributor. If the time lost is the result of a Force Majeure event, the provisions of Article VII shall apply. Invoices shall be clearly typed in English and include a unique invoice number for reference purposes.52.232-19 Availability of Funds for the Next Fiscal Year.

As prescribed in 32.706-1(b), insert the following clause: AVAILABILITY OF FUNDS FOR THE NEXT FISCAL YEAR (APR 1984)

Funds are not presently available for performance under this contract beyond September 21, 2015. The Government’s obligation for performance of this contract beyond that date is contingent upon the availability of appropriated funds from which payment for contract purposes can be made. No legal liability on the part of the Government for any payment may arise for performance under this contract beyond September 21, 2015, until funds are made available to the Contracting Officer for performance and until the Contractor receives notice of availability, to be confirmed in writing by the Contracting Officer.

(End of clause)

Offers are due no later than 4:00 p.m. EDT on Wednesday, September 3, 2014 via mail carriers of delivery to the address shown above or by e-mail to dsturgis@bbg.gov; and amartine@bbg.gov. NO FAX PROPOSALS WILL BE ACCEPTED. All offers must be signed. Offers shall include: Company Name; Company Address, Tax Payer ID Number, DUNS Number, a list of three references with telephone numbers among other requirements set forth in this document. All offerors shall provide proof of registration within the System for Award Management “SAM”

https://www.sam.gov/portal/public/SAM/

QUESTIONS: If the offeror is uncertain as to any requirements of the specification(s), such questions should be directed to the Contracting Officer. Questions should be submitted via email to dsturgis@bbg.gov. Questions must be received no later than 1:00 p.m. (EDT) on Tuesday, August 26, 2014. Questions which are not submitted in writing or are submitted after 1:00 p.m. (EDT) on Tuesday, August 26, 2014, will not be addressed. Responses to the questions submitted, if/as appropriate, will be responded to via an amendment to the solicitation only, which will be posted to FEDBIZOPPS.

ADDITIONAL INFORMATION: TELEPHONE INQUIRES WILL NOT BE ACCEPTED.

This acquisition is being solicited as Full and Open Competition. The associated NAICS code for this procurement is 515111/515120. The Government intends to award a Single Firm-Fixed Price contract but reserves the right to make multiple awards as a result of this solicitation. APPLICABILITY OF FAR PROVISIONS:

52.202-1 Definitions.

As prescribed in 2.201, insert the following clause: DEFINITIONS (JAN 2012)

(a) When a solicitation provision or contract clause uses a word or term that is defined in the Federal Acquisition Regulation (FAR), the word or term has the same meaning as the definition in FAR 2.101 in effect at the time the solicitation was issued, unless-(1) The solicitation, or amended solicitation, provides a different definition;

(2) The contracting parties agree to a different definition; (3) The part, subpart, or section of the FAR where the

provision or clause is prescribed provides a different meaning; or (4) The word or term is defined in FAR Part 31, for use in the cost principles and procedures. (b) The FAR Index is a guide to words and terms the FAR

defines and shows where each definition is located. The FAR Index is available via the Internet at http://www.acquisition.gov/far at the end of the FAR, after the FAR Appendix.52.203-5 Covenant Against Contingent Fees.

As prescribed in 3.404, insert the following clause: COVENANT AGAINST CONTINGENT FEES (APR 1984) (a) The Contractor warrants that no person or agency has been employed or retained to solicit or obtain this contract upon an agreement or understanding for a contingent fee, except a bona fide employee or agency. For breach or violation of this warranty, the Government shall have the right to annul this contract without liability or, in its discretion, to

deduct from the contract price or consideration, or otherwise recover, the full amount of the contingent fee.(b) “Bona fide agency,” as used in this clause, means an established commercial or selling agency, maintained by a

contractor for the purpose of securing business, that neither exerts nor proposes to exert improper influence to solicit or obtain Government contracts nor holds itself out as being able to obtain any Government contract or contracts through improper influence.”Bona fide employee,” as used in this clause, means a person, employed by a contractor and subject to the contractor’s supervision and control as to time, place, and manner of performance, who neither exerts nor proposes to exert improper influence to solicit or obtain Government contracts nor holds

out as being able to obtain any Government contract or contracts through improper influence. “Contingent fee,” as used in this clause, means any commission, percentage, brokerage, or other fee that is contingent upon the success that a person or concern has in securing a Government contract. “Improper influence,” as used in this clause, means any influence that induces or tends to induce a Government employee or officer to give consideration or to act regarding a Government contract on any basis other than the merits of the matter.

(End of clause)

52.203-6 Restrictions on Subcontractor Sales to the Government.

Alternate I (Oct 1995). As prescribed in 3.503-2, substitute the following paragraph in place of paragraph (b) of the

basic clause:(b) The prohibition in paragraph (a) of this clause does not preclude the Contractor from asserting rights that are otherwise authorized by law or regulation. For acquisitions of commercial items, the prohibition in paragraph (a) applies only to the extent that any agreement restricting sales by subcontractors results in the Federal Government being treated differently from any other prospective purchaser for the sale of the commercial item(s).52.212-1 Instructions to Offerors-Commercial Items.

As prescribed in 12.301(b)(1), insert the following provision:

INSTRUCTIONS TO OFFERORS-COMMERCIAL ITEMS (APR 2014)

(a) North American Industry Classification System (NAICS) code and small business size standard. The NAICS

code and small business size standard for this acquisition appear in Block 10 of the solicitation cover sheet (SF 1449). However, the small business size standard for a concern which submits an offer in its own name, but which proposes to furnish an item which it did not itself manufacture, is 500 employees.

(b) Submission of offers. Submit signed and dated offers to the office specified in this solicitation at or before the exact time specified in this solicitation. Offers may be submitted on the SF 1449, letterhead stationery, or as otherwise specified in the solicitation. As a minimum, offers must show-

(1) The solicitation number;

(2) The time specified in the solicitation for receipt of offers;

(3) The name, address, and telephone number of the offeror;

(4) A technical description of the items being offered in sufficient detail to evaluate compliance with the requirements in the solicitation. This may include product literature, or other documents, if necessary;

(5) Terms of any express warranty;

(6) Price and any discount terms;

(7) “Remit to” address, if different than mailing address;

(8) A completed copy of the representations and certifications at FAR 52.212-3 (see FAR 52.212-3(b) for those

representations and certifications that the offeror shall complete electronically);

(9) Acknowledgment of Solicitation Amendments;

(10) Past performance information, when included as an evaluation factor, to include recent and relevant contracts for the same or similar items and other references (including contract numbers, points of contact with telephone numbers and other relevant information); and

(11) If the offer is not submitted on the SF 1449, include a statement specifying the extent of agreement with all terms, conditions, and provisions included in the solicitation. Offers that fail to furnish required representations or information, or reject the terms and conditions of the solicitation may be excluded from consideration.

(c) Period for acceptance of offers. The offeror agrees to hold the prices in its offer firm for 30 calendar days from the date specified for receipt of offers, unless another time period is specified in an addendum to the solicitation.

(d) Product samples. When required by the solicitation, product samples shall be submitted at or prior to the time specified for receipt of offers. Unless otherwise specified in this solicitation, these samples shall be submitted at no expense to the Government, and returned at the sender’s request and expense, unless they are destroyed during preaward testing.

(e) Multiple offers. Offerors are encouraged to submit multiple offers presenting alternative terms and conditions or

commercial items for satisfying the requirements of this solicitation. Each offer submitted will be evaluated separately.

(f) Late submissions, modifications, revisions, and withdrawals of offers. (1) Offerors are responsible for submitting

offers, and any modifications, revisions, or withdrawals, so as to reach the Government office designated in the solicitation by the time specified in the solicitation. If no time is specified in the solicitation, the time for receipt is 4:30 p.m., local time, for the designated Government office on the date that offers or revisions are due.

(2)(i) Any offer, modification, revision, or withdrawal of an offer received at the Government office designated in the solicitation after the exact time specified for receipt of offers is “late” and will not be considered unless it is received before award is made, the Contracting Officer determines that accepting the late offer would not unduly delay the acquisition; and-

(A) If it was transmitted through an electronic commerce method authorized by the solicitation, it was

received at the initial point of entry to the Government infrastructure not later than 5:00 p.m. one working day prior to the date specified for receipt of offers; or

(B) There is acceptable evidence to establish that it was received at the Government installation designated for

receipt of offers and was under the Government’s control prior to the time set for receipt of offers; or

(C) If this solicitation is a request for proposals, it was the only proposal received.

(ii) However, a late modification of an otherwise successful offer, that makes its terms more favorable to the

Government, will be considered at any time it is received and may be accepted.

(3) Acceptable evidence to establish the time of receipt at the Government installation includes the time/date stamp of that installation on the offer wrapper, other documentary evidence of receipt maintained by the installation, or oral testimony or statements of Government personnel.

(4) If an emergency or unanticipated event interrupts normal Government processes so that offers cannot be

received at the Government office designated for receipt of offers by the exact time specified in the solicitation, and

urgent Government requirements preclude amendment of the solicitation or other notice of an extension of the closing date, the time specified for receipt of offers will be deemed to be extended to the same time of day specified in the solicitation on the first work day on which normal Government processes resume.

(5) Offers may be withdrawn by written notice received at any time before the exact time set for receipt of offers. Oral offers in response to oral solicitations may be withdrawn orally. If the solicitation authorizes facsimile offers, offers may be withdrawn via facsimile received at any time before the exact time set for receipt of offers, subject to the conditions specified in the solicitation concerning facsimile offers. An offer may be withdrawn in person by an offeror or its authorized representative if, before the exact time set for receipt of offers, the identity of the person requesting withdrawal is established and the person signs a receipt for the offer.

(g) Contract award (not applicable to Invitation for Bids). The Government intends to evaluate offers and award a contract without discussions with offerors. Therefore, the offeror’s initial offer should contain the offeror’s best terms from a price and technical standpoint. However, the Government reserves the right to conduct discussions if later determined by the Contracting Officer to be necessary. The Government may reject any or all offers if such action is in the public interest; accept other than the lowest offer; and waive informalities and minor irregularities in offers received.

(h) Multiple awards. The Government may accept any item or group of items of an offer, unless the offeror qualifies the offer by specific limitations. Unless otherwise provided in the Schedule, offers may not be submitted for quantities less than those specified. The Government reserves the right to make an award on any item for a quantity less than the quantity offered, at the unit prices offered, unless the offeror specifies otherwise in the offer.

(i) Availability of requirements documents cited in the solicitation. (1)(i) The GSA Index of Federal Specifications,

Standards and Commercial Item Descriptions, FPMR Part 101-29, and copies of specifications, standards, and commercial item descriptions cited in this solicitation may be obtained for a fee by submitting a request to-

GSA Federal Supply Service Specifications Section

Suite 8100

470 East L’Enfant Plaza, SW

Washington, DC 20407

Telephone (202) 619-8925

Facsimile (202) 619-8978.

(ii) If the General Services Administration, Department of Agriculture, or Department of Veterans Affairs issued

this solicitation, a single copy of specifications, standards, and commercial item descriptions cited in this solicitation may be obtained free of charge by submitting a request to the addressee in paragraph (i)(1)(i) of this provision. Additional copies will be issued for a fee.

(2) Most unclassified Defense specifications and standards may be downloaded from the following ASSIST websites:

(i) ASSIST (http://assist.daps.dla.mil).

(ii) Quick Search (http://assist.daps.dla.mil/quicksearch).

(iii) ASSISTdocs.com (http://assistdocs.com).

(3) Documents not available from ASSIST may be ordered from the Department of Defense Single Stock Point

(DoDSSP) by-

(i) Using the ASSIST Shopping Wizard (http://assist.daps.dla.mil/wizard);

(ii) Phoning the DoDSSP Customer Service Desk

(215) 697-2179, Mon-Fri, 0730 to 1600 EST; or

(iii) Ordering from DoDSSP, Building 4, Section D,

700 Robbins Avenue, Philadelphia, PA 19111-5094, Telephone

(215) 697-2667/2179, Facsimile (215) 697-1462.

(4) Nongovernment (voluntary) standards must be obtained from the organization responsible for their preparation,

publication, or maintenance.

(j) Data Universal Numbering System (DUNS) Number.(Applies to all offers exceeding $3,000, and offers of $3,000

or less if the solicitation requires the Contractor to be registered in the System for Award Management (SAM) database.) The offeror shall enter, in the block with its name and address on the cover page of its offer, the annotation “DUNS” or “DUNS+4” followed by the DUNS or DUNS+4 number that identifies the offeror’s name and address. The DUNS+4 is the DUNS number plus a 4-character suffix that may be assigned at the discretion of the offeror to establish additional SAM records for identifying alternative Electronic Funds Transfer (EFT) accounts (see FAR Subpart 32.11) for the same concern. If the offeror does not have a DUNS number, it should contact Dun and Bradstreet directly to obtain one. An offeror within the United States may contact Dun and Bradstreet by

calling 1-866-705-5711 or via the internet at http://fedgov.dnb.com/webform. An offeror located outside the

United States must contact the local Dun and Bradstreet office for a DUNS number. The offeror should indicate that it is an offeror for a Government contract when contacting the local Dun and Bradstreet office.

(k) System for Award Management. Unless exempted by an addendum to this solicitation, by submission of an offer,

the offeror acknowledges the requirement that a prospective awardee shall be registered in the SAM database prior to award, during performance and through final payment of any contract resulting from this solicitation. If the Offeror does not become registered in the SAM database in the time prescribed by the Contracting Officer, the Contracting Officer will proceed to award to the next otherwise successful registered Offeror. Offerors may obtain information on registration and annual confirmation requirements via the SAM database accessed through https://www.acquisition.gov.(l) Debriefing. If a post-award debriefing is given to requesting offerors, the Government shall disclose the following information, if applicable:

(1) The agency’s evaluation of the significant weak or deficient factors in the debriefed offeror’s offer.

(2) The overall evaluated cost or price and technical rating of the successful and the debriefed offeror and past performance information on the debriefed offeror.

(3) The overall ranking of all offerors, when any ranking was developed by the agency during source selection.

(4) A summary of the rationale for award;

(5) For acquisitions of commercial items, the make and model of the item to be delivered by the successful offeror.

(6) Reasonable responses to relevant questions posed by the debriefed offeror as to whether source-selection procedures set forth in the solicitation, applicable regulations, and other applicable authorities were followed by the agency.

(End of provision)

52.212-2 Evaluation-Commercial Items.

As prescribed in 12.301(c), the Contracting Officer may insert a provision substantially as follows:

EVALUATION-COMMERCIAL ITEMS (JAN 1999)

(a) The Government will award a contract resulting from this solicitation to the responsible offeror whose offer conforming to the solicitation will be most advantageous to the Government, price and other factors considered. The following factors shall be used to evaluate offers:

Technical capability Experience

Price

Past PerformanceTechnical and past performance, when combined, are approximately equal to cost or price [Contracting Officer state, in accordance with FAR 15.304, the relative importance of all other evaluation factors, when combined, when compared to price.] (b) Options. The Government will evaluate offers for award purposes by adding the total price for all options to the

total price for the basic requirement. The Government may determine that an offer is unacceptable if the option prices are significantly unbalanced. Evaluation of options shall not obligate the Government to exercise the option(s).

(c) A written notice of award or acceptance of an offer, mailed or otherwise furnished to the successful offeror within the time for acceptance specified in the offer, shall result in a binding contract without further action by either party. Before the offer’s specified expiration time, the Government may accept an offer (or part of an offer), whether or not there are negotiations after its receipt, unless a written notice of withdrawal is received before award.

(End of provision)52.212-3 Offeror Representations and Certifications-Commercial Items.

As prescribed in 12.301(b)(2), insert the following provision:

OFFEROR REPRESENTATIONS AND CERTIFICATIONS-COMMERCIAL ITEMS (MAY 2014)

An offeror shall complete only paragraph (b) of this provision if the offeror has completed the annual representations and certifications electronically via http://www.acquisition.gov. If an offeror has not completed the

annual representations and certifications electronically at the System for Award Management (SAM) website, the offeror shall complete only paragraphs (c) through (o) of this provision.

(a) Definitions. As used in this provision-

“Economically disadvantaged women-owned small business (EDWOSB) concern” means a small business concern that is at least 51 percent directly and unconditionally owned by, and the management and daily business operations of which are controlled by, one or more women who are citizens of the United States and who are economically disadvantaged in accordance with 13 CFR part 127. It automatically qualifies as a women-owned small business eligible under the WOSB Program.

“Forced or indentured child labor” means all work or service-

(1) Exacted from any person under the age of 18 under the menace of any penalty for its nonperformance and for

which the worker does not offer himself voluntarily; or

(2) Performed by any person under the age of 18 pursuant to a contract the enforcement of which can be accomplished by process or penalties. “Inverted domestic corporation”, as used in this section, means a foreign incorporated entity which is treated as an inverted domestic corporation under 6 U.S.C. 395(b), i.e., a corporation that used to be incorporated in the United States, or used to be a partnership in the United States, but now is

incorporated in a foreign country, or is a subsidiary whose parent corporation is incorporated in a foreign country, that meets the criteria specified in 6 U.S.C. 395(b), applied in accordance with the rules and definitions of 6 U.S.C. 395(c). An inverted domestic corporation as herein defined does not meet the definition of an inverted domestic corporation as defined by the Internal Revenue Code at 26 U.S.C. 7874. “Manufactured end product” means any end product in Federal Supply Classes (FSC) 1000-9999, except-

(1) FSC 5510, Lumber and Related Basic Wood Materials;

(2) Federal Supply Group (FSG) 87, Agricultural Supplies;

(3) FSG 88, Live Animals;

(4) FSG 89, Food and Related Consumables;

(5) FSC 9410, Crude Grades of Plant Materials;

(6) FSC 9430, Miscellaneous Crude Animal Products, Inedible;

(7) FSC 9440, Miscellaneous Crude Agricultural and Forestry Products;

(8) FSC 9610, Ores;

(9) FSC 9620, Minerals, Natural and Synthetic; and

(10) FSC 9630, Additive Metal Materials.

“Place of manufacture” means the place where an end product is assembled out of components, or otherwise made

or processed from raw materials into the finished product that is to be provided to the Government. If a product is disassembled and reassembled, the place of reassembly is not the place of manufacture. “Restricted business operations” means business operations in Sudan that include power production activities, mineral

extraction activities, oil-related activities, or the production of military equipment, as those terms are defined

in the Sudan Accountability and Divestment Act of 2007 (Pub. L. 110-174). Restricted business operations do not

include business operations that the person (as that term is defined in Section 2 of the Sudan Accountability and Divestment Act of 2007) conducting the business can demonstrate-

(1) Are conducted under contract directly and exclusively with the regional government of southern Sudan;

(2) Are conducted pursuant to specific authorization from the Office of Foreign Assets Control in the Department

of the Treasury, or are expressly exempted under Federal law from the requirement to be conducted under such authorization;

(3) Consist of providing goods or services to marginalized populations of Sudan;

(4) Consist of providing goods or services to an internationally recognized peacekeeping force or humanitarian

organization;

(5) Consist of providing goods or services that are used only to promote health or education; or

(6) Have been voluntarily suspended.

“Sensitive technology”-

(1) Means hardware, software, telecommunications equipment, or any other technology that is to be used specifically-

(i) To restrict the free flow of unbiased information in Iran; or

(ii) To disrupt, monitor, or otherwise restrict speech of the people of Iran; and

(2) Does not include information or informational materials

the export of which the President does not have the authority to regulate or prohibit pursuant to section 203(b)(3)

of the International Emergency Economic Powers Act (50U.S.C. 1702(b)(3)).

“Service-disabled veteran-owned small business concern”-

(1) Means a small business concern-

(i) Not less than 51 percent of which is owned by one or more service-disabled veterans or, in the case of any publicly owned business, not less than 51 percent of the stock of which is owned by one or more service-disabled veterans; and

(ii) The management and daily business operations of which are controlled by one or more service-disabled veterans

or, in the case of a service-disabled veteran with permanent and severe disability, the spouse or permanent caregiver

of such veteran.

(2) Service-disabled veteran means a veteran, as defined in 38 U.S.C. 101(2), with a disability that is service connected, as defined in 38 U.S.C. 101(16).

“Small business concern” means a concern, including its affiliates, that is independently owned and operated, not dominant in the field of operation in which it is bidding on Government contracts, and qualified as a small business under the criteria in 13 CFR Part 121 and size standards in this solicitation.

“Subsidiary” means an entity in which more than 50 percent of the entity is owned-

(1) Directly by a parent corporation; or

(2) Through another subsidiary of a parent corporation.

“Veteran-owned small business concern” means a small business concern-

(1) Not less than 51 percent of which is owned by one or more veterans (as defined at 38 U.S.C. 101(2)) or, in the

case of any publicly owned business, not less than 51 percent of the stock of which is owned by one or more veterans; and

(2) The management and daily business operations of which are controlled by one or more veterans.

“Women-owned business concern” means a concern which is at least 51 percent owned by one or more women; or

in the case of any publicly owned business, at least 51 percent of its stock is owned by one or more women; and whose management and daily business operations are controlled by one or more women.

“Women-owned small business concern” means a small business concern-

(1) That is at least 51 percent owned by one or more women; or, in the case of any publicly owned business, at least

51 percent of the stock of which is owned by one or more women; and

(2) Whose management and daily business operations are controlled by one or more women.

“Women-owned small business (WOSB) concern eligible under the WOSB Program” (in accordance with 13 CFR part 127), means a small business concern that is at least 51 percent directly and unconditionally owned by, and the management and daily business operations of which are controlled by, one or more women who are citizens of the United States.

(b) (1) Annual Representations and Certifications. Any changes provided by the offeror in paragraph (b)(2) of this

provision do not automatically change the representations and certifications posted on the SAM website.

(2) The offeror has completed the annual representations and certifications electronically via the SAM website

accessed through http://www.acquisition.gov. After reviewing the SAM database information, the offeror verifies by submission of this offer that the representations and certifications currently posted electronically at FAR 52.212-3, Offeror Representations and Certifications-Commercial Items, have been entered or updated in the last 12 months, are current, accurate, complete, and applicable to this solicitation (including the business size standard applicable to the NAICS code referenced for this solicitation), as of the date of this offer and are incorporated in this offer by reference (see FAR 4.1201), except for paragraphs ______________.[Offeror to identify the applicable paragraphs at (c)through (o) of this provision that the offeror has completed for the purposes of this solicitation only, if any.

These amended representation(s) and/or certification(s)are also incorporated in this offer and are current, accurate,

and complete as of the date of this offer. Any changes provided by the offeror are applicable to this solicitation only, and do not result in an update to the representations and certifications posted electronically on SAM.] (c) Offerors must complete the following representations when the resulting contract will be performed in the United

States or its outlying areas. Check all that apply.

(1) Small business concern. The offeror represents as part of its offer that it ❏ is, ❏ is not a small business concern.

(2) Veteran-owned small business concern. [Complete only if the offeror represented itself as a small business concern in paragraph (c)(1) of this provision.] The offeror represents as part of its offer that it ❏ is, ❏ is not a veteran-owned small business concern.

(3) Service-disabled veteran-owned small business concern. [Complete only if the offeror represented itself as a

veteran-owned small business concern in paragraph (c)(2) of this provision.] The offeror represents as part of its offer that it ❏ is, ❏ is not a service-disabled veteran-owned small business concern.

(4) Small disadvantaged business concern. [Complete only if the offeror represented itself as a small business concern in paragraph (c)(1) of this provision.] The offeror represents, for general statistical purposes, that it ❏ is, ❏ is not a small disadvantaged business concern as defined in 13 CFR 124.1002.

(5) Women-owned small business concern. [Complete only if the offeror represented itself as a small business concern in paragraph (c)(1) of this provision.] The offeror represents that it ❏ is, ❏ is not a women-owned small business concern.

(6) WOSB concern eligible under the WOSB Program. [Complete only if the offeror represented itself as a women owned small business concern in paragraph (c)(5) of this provision.] The offeror represents that-

(i) It ❏ is,❏ is not a WOSB concern eligible under the WOSB Program, has provided all the required documents

to the WOSB Repository, and no change in circumstances or adverse decisions have been issued that affects its eligibility; and

(ii) It ❏ is, ❏ is not a joint venture that complies with the requirements of 13 CFR part 127, and the representation

in paragraph (c)(6)(i) of this provision is accurate for each WOSB concern eligible under the WOSB Program participating in the joint venture. [The offeror shall enter the name or names of the WOSB concern eligible under the WOSB Program and other small businesses that are participating in the joint venture: __________.] Each WOSB concern eligible under the WOSB Program participating in the joint venture shall submit a separate signed copy of the WOSB representation.

(7) Economically disadvantaged women-owned small business (EDWOSB) concern. [Complete only if the offeror

represented itself as a WOSB concern eligible under the WOSB Program in (c)(6) of this provision.] The offeror represents that-

(i) It ❏ is, ❏ is not an EDWOSB concern, has provided all the required documents to the WOSB Repository,

and no change in circumstances or adverse decisions have been issued that affects its eligibility; and

(ii) It ❏ is, ❏ is not a joint venture that complies with the requirements of 13 CFR part 127, and the representation

in paragraph (c)(7)(i) of this provision is accurate for each EDWOSB concern participating in the joint venture. [The offeror shall enter the name or names of the EDWOSB concern and other small businesses that are participating in the joint venture: __________.] Each EDWOSB concern participating in the joint venture shall submit a separate signed copy of the EDWOSB representation.

NOTE: Complete paragraphs (c)(8) and (c)(9) only if this solicitation is expected to exceed the simplified acquisition

threshold.

(8) Women-owned business concern (other than small business concern). [Complete only if the offeror is a women owned business concern and did not represent itself as a small business concern in paragraph (c)(1) of this provision.] The offeror represents that it ❏ is a women-owned business concern.

(9) Tie bid priority for labor surplus area concerns. If this is an invitation for bid, small business offerors may identify the labor surplus areas in which costs to be incurred on account of manufacturing or production (by offeror or first tier subcontractors) amount to more than 50 percent of the contract price:____________________________________

(10) [Complete only if the solicitation contains the clause at FAR 52.219-23, Notice of Price Evaluation Adjustment

for Small Disadvantaged Business Concerns, or FAR 52.219-25, Small Disadvantaged Business Participation

Program-Disadvantaged Status and Reporting, and the offeror desires a benefit based on its disadvantaged status.] (i) General. The offeror represents that either-

(A) It ❏ is, ❏ is not certified by the Small Business Administration as a small disadvantaged business concern

and identified, on the date of this representation, as a certified small disadvantaged business concern in the SAM

Dynamic Small Business Search database maintained by the Small Business Administration, and that no material change in disadvantaged ownership and control has occurred since its certification, and, where the concern is owned by one or more individuals claiming disadvantaged status, the net worth of each individual upon whom the certification is based does not exceed $750,000 after taking into account the applicable exclusions set forth at 13 CFR 124.104(c)(2); or

(B) It ❏ has, ❏ has not submitted a completed application to the Small Business Administration or a Private

Certifier to be certified as a small disadvantaged business concern in accordance with 13 CFR 124, Subpart B, and a decision on that application is pending, and that no material change in disadvantaged ownership and control has occurred since its application was submitted.

(ii) ❏ Joint Ventures under the Price Evaluation

Adjustment for Small Disadvantaged Business Concerns. The offeror represents, as part of its offer, that it is a joint venture that complies with the requirements in 13 CFR 124.1002(f) and that the representation in paragraph (c)(10)(i) of this provision is accurate for the small disadvantaged business concern that is participating in the joint venture. [The offeror shall enter the name of the small disadvantaged business concern that is participating in the joint venture:________________.] (11) HUBZone small business concern. [Complete only if the offeror represented itself as a small business concern in paragraph (c)(1) of this provision.] The offeror represents, as part of its offer, that-

(i) It ❏ is, ❏ is not a HUBZone small business concern listed, on the date of this representation, on the List of

Qualified HUBZone Small Business Concerns maintained by the Small Business Administration, and no material changes in ownership and control, principal office, or HUBZone employee percentage have occurred since it was certified in accordance with 13 CFR Part 126; and

(ii) It ❏ is, ❏ is not a HUBZone joint venture that complies with the requirements of 13 CFR Part 126, and the

representation in paragraph (c)(11)(i) of this provision is accurate for each HUBZone small business concern participating in the HUBZone joint venture. [The offeror shall enter the names of each of the HUBZone small business concerns participating in the HUBZone joint venture: __________.] Each HUBZone small business concern participating in the HUBZone joint venture shall submit a separate signed copy of the HUBZone representation.

(d) Representations required to implement provisions of Executive Order 11246-(1) Previous contracts and compliance.

The offeror represents that-

(i) It ❏ has, ❏ has not participated in a previous contract or subcontract subject to the Equal Opportunity clause of

this solicitation; and

(ii) It ❏ has, ❏ has not filed all required compliance reports.

(2) Affirmative Action Compliance. The offeror represents

that-

(i) It ❏ has developed and has on file, ❏ has not developed and does not have on file, at each establishment,

affirmative action programs required by rules and regulations of the Secretary of Labor (41 CFR parts 60-1 and 60-2), or

(ii) It ❏ has not previously had contracts subject to the written affirmative action programs requirement of the rules and regulations of the Secretary of Labor.

(e) Certification Regarding Payments to Influence Federal Transactions (31 U.S.C. 1352). (Applies only if the contract is expected to exceed $150,000.) By submission of its offer, the offeror certifies to the best of its knowledge and belief that no Federal appropriated funds have been paid or will be paid to any person for influencing or attempting to influence an officer or employee of any agency, a Member of Congress, an officer or employee of Congress or an employee of a Member of Congress on his or her behalf in connection with the award of any resultant contract. If any registrants under the Lobbying Disclosure Act of 1995 have made a lobbying contact on

behalf of the offeror with respect to this contract, the offeror shall complete and submit, with its offer, OMB Standard

Form LLL, Disclosure of Lobbying Activities, to provide the name of the registrants. The offeror need not report regularly employed officers or employees of the offeror to whom payments of reasonable compensation were made.

(f) Buy American Act Certificate. (Applies only if the clause at Federal Acquisition Regulation (FAR) 52.225-1,

Buy American Act-Supplies, is included in this solicitation.)

(1) The offeror certifies that each end product, except those listed in paragraph (f)(2) of this provision, is a domestic

end product and that for other than COTS items, the offeror has considered components of unknown origin to have been mined, produced, or manufactured outside the United States. The offeror shall list as foreign end products those end products manufactured in the United States that do not qualify as domestic end products, i.e., an end product that is not a COTS item and does not meet the component test in paragraph (2) of the definition of “domestic end product.” The terms “commercially available off-the-shelf (COTS) item” “component,” “domestic end product,” “end product,” “foreign end product,” and “United States” are defined in the clause of this solicitation entitled “Buy American Act-Supplies.”

(2) Foreign End Products:

[List as necessary] (3) The Government will evaluate offers in accordance with the policies and procedures of FAR Part 25.

(g)(1) Buy American Act-Free Trade Agreements-Israeli Trade Act Certificate. (Applies only if the clause at

FAR 52.225-3, Buy American Act-Free Trade Agreements-Israeli Trade Act, is included in this solicitation.)

(i) The offeror certifies that each end product, except those listed in paragraph (g)(1)(ii) or (g)(1)(iii) of this provision, is a domestic end product and that for other than COTS items, the offeror has considered components of unknown origin to have been mined, produced, or manufactured outside the United States. The terms “Bahrainian, Moroccan, Omani, Panamanian, or Peruvian end product,” “commercially available off-the-shelf (COTS) item,” “component,” “domestic end product,” “end product,” “foreign end product,” “Free Trade Agreement country,” “Free Trade Agreement country end product,” “Israeli end product,” and “United States” are defined in the clause of this solicitation entitled “Buy American Act-Free Trade Agreements-Israeli Trade Act.”

(ii) The offeror certifies that the following supplies are Free Trade Agreement country end products (other than

Bahrainian, Moroccan, Omani, Panamanian, or Peruvian end products) or Israeli end products as defined in the clause of this solicitation entitled “Buy American Act-Free Trade Agreements-Israeli Trade Act”: Free Trade Agreement Country End Products (Other than Bahrainian, Moroccan, Omani, Panamanian, or Peruvian End Products) or Israeli End Products:

[List as necessary] (iii) The offeror shall list those supplies that are foreign end products (other than those listed in paragraph (g)(1)(ii) of this provision) as defined in the clause of this solicitation entitled “Buy American Act-Free Trade

Agreements-Israeli Trade Act.” The offeror shall list as other foreign end products those end products manufactured in the United States that do not qualify as domestic end products, i.e., an end product that is not a COTS item and does not meet the component test in paragraph (2) of the definition of “domestic end product.”

Other Foreign End Products:

[List as necessary] (iv) The Government will evaluate offers in accordance with the policies and procedures of FAR Part 25.

(2) Buy American Act-Free Trade Agreements-Israeli Trade Act Certificate, Alternate I. If Alternate I to the

clause at FAR 52.225-3 is included in this solicitation, substitute the following paragraph (g)(1)(ii) for paragraph (g)(1)(ii) of the basic provision:

(g)(1)(ii) The offeror certifies that the following supplies are Canadian end products as defined in the clause of this solicitation entitled “Buy American Act-Free Trade Agreements-Israeli Trade Act”:

Canadian End Products:

[List as necessary] (3) Buy American Act-Free Trade Agreements- Israeli Trade Act Certificate, Alternate II. If Alternate II to

the clause at FAR 52.225-3 is included in this solicitation, substitute the following paragraph (g)(1)(ii) for

paragraph (g)(1)(ii) of the basic provision:

(g)(1)(ii) The offeror certifies that the following supplies are Canadian end products or Israeli end products as defined in the clause of this solicitation entitled “Buy American Act-Free Trade Agreements-Israeli Trade Act”:

Canadian or Israeli End Products:

[List as necessary] (4) Buy American Act-Free Trade Agreements-Israeli Trade Act Certificate, Alternate III. If Alternate III to

the clause at 52.225-3 is included in this solicitation, substitute the following paragraph (g)(1)(ii) for paragraph (g)(1)(ii)

of the basic provision:

(g)(1)(ii) The offeror certifies that the following supplies are Free Trade Agreement country end products (other than Bahrainian, Korean, Moroccan, Omani, Panamanian, or Peruvian end products) or Israeli end products as defined in the clause of this solicitation entitled “Buy American Act-Free Trade Agreements-Israeli Trade Act”: Free Trade Agreement Country End Products (Other than Bahrainian, Korean, Moroccan, Omani, Panamanian, or Peruvian End Products) or Israeli End Products:

[List as necessary] (5) Trade Agreements Certificate. (Applies only if the clause at FAR 52.225-5, Trade Agreements, is included in this solicitation.)

(i) The offeror certifies that each end product, except those listed in paragraph (g)(5)(ii) of this provision, is a U.S.-

made or designated country end product, as defined in the clause of this solicitation entitled “Trade Agreements.”

(ii) The offeror shall list as other end products those end products that are not U.S.-made or designated country end

products.

Other End Products:

[List as necessary] (iii) The Government will evaluate offers in accordance with the policies and procedures of FAR Part 25. For

line items covered by the WTO GPA, the Government will evaluate offers of U.S.-made or designated country end products without regard to the restrictions of the Buy American Act. The Government will consider for award only offers of U.S.-made or designated country end products unless the Contracting Officer determines that there are no offers for such products or that the offers for such products are insufficient to fulfill the requirements of the solicitation.

(h) Certification Regarding Responsibility Matters (Executive Order 12689). (Applies only if the contract value is

expected to exceed the simplified acquisition threshold.) The offeror certifies, to the best of its knowledge and belief, that the offeror and/or any of its principals-

(1) ❏ Are, ❏ are not presently debarred, suspended, proposed for debarment, or declared ineligible for the award

of contracts by any Federal agency;

(2) ❏ Have, ❏ have not, within a three-year period preceding this offer, been convicted of or had a civil judgment

rendered against them for: commission of fraud or a criminal offense in connection with obtaining, attempting to obtain, or performing a Federal, state or local government contract or subcontract; violation of Federal or state antitrust statutes relating to the submission of offers; or commission of embezzlement, theft, forgery, bribery, falsification or destruction of records, making false statements, tax evasion, violating Federal criminal tax laws, or receiving stolen property;

(3) ❏ Are, ❏ are not presently indicted for, or otherwise criminally or civilly charged by a Government entity with,

commission of any of these offenses enumerated in paragraph (h)(2) of this clause; and

(4) ❏ Have, ❏ have not, within a three-year period preceding this offer, been notified of any delinquent Federal

taxes in an amount that exceeds $3,000 for which the liability remains unsatisfied.

(i) Taxes are considered delinquent if both of the following criteria apply:

(A) The tax liability is finally determined. The liability is finally determined if it has been assessed. A liability

is not finally determined if there is a pending administrative or judicial challenge. In the case of a judicial challenge to the liability, the liability is not finally determined until all judicial appeal rights have been exhausted.

(B) The taxpayer is delinquent in making payment. A taxpayer is delinquent if the taxpayer has failed to pay

the tax liability when full payment was due and required. A taxpayer is not delinquent in cases where enforced collection action is precluded.

(ii) Examples. (A) The taxpayer has received a statutory notice of deficiency, under I.R.C. §6212, which entitles

the taxpayer to seek Tax Court review of a proposed tax deficiency. This is not a delinquent tax because it is not a final tax liability. Should the taxpayer seek Tax Court review, this will not be a final tax liability until the taxpayer has exercised all judicial appeal rights.

(B) The IRS has filed a notice of Federal tax lien with respect to an assessed tax liability, and the taxpayer has

been issued a notice under I.R.C. §6320 entitling the taxpayer to request a hearing with the IRS Office of Appeals contesting the lien filing, and to further appeal to the Tax Court if the IRS determines to sustain the lien filing. In the course of the hearing, the taxpayer is entitled to contest the underlying tax liability because the taxpayer has had no prior opportunity to contest the liability. This is not a delinquent tax because it is not a final tax liability. Should the taxpayer seek tax court review, this will not be a final tax liability until the taxpayer has exercised all judicial appeal rights.

(C) The taxpayer has entered into an installment agreement pursuant to I.R.C. §6159. The taxpayer is making

timely payments and is in full compliance with the agreement terms. The taxpayer is not delinquent because the taxpayer is not currently required to make full payment.

(D) The taxpayer has filed for bankruptcy protection. The taxpayer is not delinquent because enforced collection

action is stayed under 11 U.S.C. §362 (the Bankruptcy Code).

(i) Certification Regarding Knowledge of Child Labor for Listed End Products (Executive Order 13126). [The Contracting Officer must list in paragraph (i)(1) any end products being acquired under this solicitation that are included in the List of Products Requiring Contractor Certification as to Forced or Indentured Child Labor, unless excluded at 22.1503(b).] (1) Listed end products.

(2) Certification. [If the Contracting Officer has identified end products and countries of origin in paragraph (i)(1)

of this provision, then the offeror must certify to either (i)(2)(i) or (i)(2)(ii) by checking the appropriate block.] [ ] (i) The offeror will not supply any end product listed in paragraph (i)(1) of this provision that was mined,

produced, or manufactured in the corresponding country as listed for that product.

[ ] (ii) The offeror may supply an end product listed in paragraph (i)(1) of this provision that was mined, produced,

or manufactured in the corresponding country as listed for that product. The offeror certifies that it has made a good faith effort to determine whether forced or indentured child labor was used to mine, produce, or manufacture any such end product furnished under this contract. On the basis of those efforts, the offeror certifies that it is not aware of any such use of child labor.

(j) Place of manufacture. (Does not apply unless the solicitation is predominantly for the acquisition of manufactured end products.) For statistical purposes only, the offeror shall indicate whether the place of manufacture of the end products it expects to provide in response to this solicitation is predominantly-

(1) ❏ In the United States (Check this box if the total anticipated price of offered end products manufactured in the

United States exceeds the total anticipated price of offered end products manufactured outside the United States); or

(2) ❏ Outside the United States.

(k) Certificates regarding exemptions from the application of the Service Contract Act. (Certification by the offeror as to its compliance with respect to the contract also constitutes itscertification as to compliance by its subcontractor if it subcontracts out the exempt services.) [The contracting officer is to check a box to indicate if paragraph (k)(1) or (k)(2) applies.] [ ] (1) Maintenance, calibration, or repair of certain equipment as described in FAR 22.1003-4(c)(1). The offeror

❏ does ❏ does not certify that-

(i) The items of equipment to be serviced under this contract are used regularly for other than Governmental purposes and are sold or traded by the offeror (or subcontractor in the case of an exempt subcontract) in substantial quantities to the general public in the course of normal business operations;

(ii) The services will be furnished at prices which are, or are based on, established catalog or market prices (see

FAR 22.1003-4(c)(2)(ii)) for the maintenance, calibration, or repair of such equipment; and

(iii) The compensation (wage and fringe benefits) plan for all service employees performing work under the contract

will be the same as that used for these employees and equivalent employees servicing the same equipment of commercial customers.

[ ] (2) Certain services as described in FAR 22.1003-4(d)(1). The offeror ❏ does ❏ does not certify

that-

(i) The services under the contract are offered and sold regularly to non-Governmental customers, and are provided

by the offeror (or subcontractor in the case of an exempt subcontract) to the general public in substantial quantities in the course of normal business operations;

(ii) The contract services will be furnished at prices that are, or are based on, established catalog or market prices

(see FAR 22.1003-4(d)(2)(iii));

(iii) Each service employee who will perform the services under the contract will spend only a small portion of

his or her time (a monthly average of less than 20 percent of the available hours on an annualized basis, or less than 20 percent of available hours during the contract period if the contract period is less than a month) servicing the Government contract; and

(iv) The compensation (wage and fringe benefits) plan for all service employees performing work under the contract

is the same as that used for these employees and equivalent employees servicing commercial customers.

(3) If paragraph (k)(1) or (k)(2) of this clause applies-

(i) If the offeror does not certify to the conditions in paragraph (k)(1) or (k)(2) and the Contracting Officer did not

attach a Service Contract Act wage determination to the solicitation, the offeror shall notify the Contracting Officer as soon as possible; and

(ii) The Contracting Officer may not make an award to the offeror if the offeror fails to execute the certification in

paragraph (k)(1) or (k)(2) of this clause or to contact the Contracting Officer as required in paragraph (k)(3)(i) of this clause.

(l) Taxpayer Identification Number (TIN) (26 U.S.C. 6109, 31 U.S.C. 7701). (Not applicable if the offeror is required to provide this information to the SAM database to be eligible for award.)

(1) All offerors must submit the information required in paragraphs (l)(3) through (l)(5) of this provision to comply

with debt collection requirements of 31 U.S.C. 7701(c) and 3325(d), reporting requirements of 26 U.S.C. 6041, 6041A, and 6050M, and implementing regulations issued by the Internal Revenue Service (IRS).

(2) The TIN may be used by the Government to collect and report on any delinquent amounts arising out of the offeror’s relationship with the Government (31 U.S.C.7701(C)(3)). If the resulting contract is subject to the payment